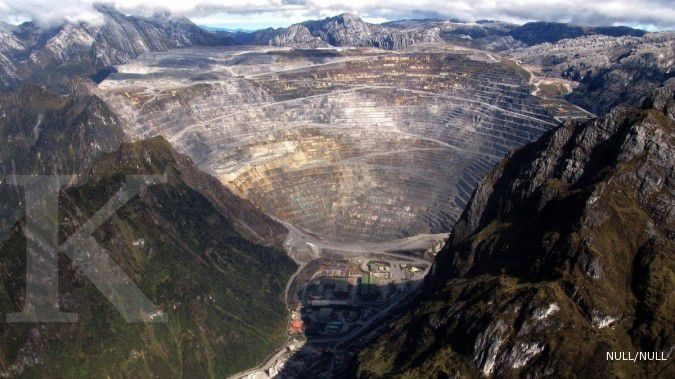

JAKARTA. Mining companies look likely to have a chance of raising money from the bourse even if they are still in the exploration stage, as the Indonesia Stock Exchange (IDX) is preparing a new regulation on its facilitation. Once the miners raise funds from the bourse, they will have the capital to boost exploration activities. IDX director for listing, Hoesen, said over the weekend the bourse had early this month submitted a revision of the requirement for mining companies to be listed on the IDX to the Financial Service Authority (OJK). Approval on the revision is expected before the end of the month. The revisions, Hoesen said, would allow miners in the exploration stage, to apply for an initial public offering (IPO) and to have their shares traded on the bourse even before they started producing and further, profiting. Once the revision comes into effect, according to Hoesen, mining companies that had not started production can go for an IPO with mineral deposit data (normally in the form of Joint Ore Reserves Committee Report), feasibility study documents and a business plan. “The deposit data will be audited by a competent independent surveyor to avoid fraud. Companies have to submit a financial report from the preceding year,” Hoesen said, adding miners that had started production but were still recording a loss could also apply for an IPO as long as they booked operating profit. “While waiting for the OJK’s approval, the bourse is currently formulating a guideline for companies’ five-year business plans, which will be offer interested investors assurance on the related firms’ businesses.” The current regulation stipulates that only companies that have operated and have audited financial reports for at least three years can have their shares listed on the bourse’s main index. As exploration takes quite a long time and takes three to five years before producing and profitability, the existing regulation is not “business friendly” to the miners. “It is always hard to raise capital to start mining, especially for first-timers, which usually depend on the owner’s own funds to finance exploitation. Bigger firms have more access to bank loans, usually using other businesses outside mining industry as the mortgage,” Tony Wenas of the Indonesian Mining Association (IMA) said. “Ores are a non-renewable resource. With a lack of capital, many explored areas are left idle due to lack of funds, therefore, a revision that facilitates IPOs will be very much appreciated,” he continued. Tony also emphasized that the bourse and the OJK should involve mining experts and the government to ensure unreliable miners were not listed on the bourse. Corporate secretary of state-run Aneka Tambang (Antam), Tri Hartono, echoed Tony, saying the revision would ease the process for miners, especially as they are now barred from exporting raw ore and obliged to build smelters. The ban, which was brought in earlier this year, stipulates that only finished products can be exported in an attempt to develop the downstream extractive industry and to increase added value for the country. Antam is reportedly preparing three of its subsidiaries — nickel miner GAG Nikel, bauxite miner Mega Citra Utama and gold miner Cibaliung Sumberdaya. “We have a list of subsidiaries that we deem ready to offer their shares to the public, but we will not conduct any IPOs until the revision is ready,” Tri said. Indosurya Analyst William Surya Wijaya said that while the revised stipulation was good to accelerate IPO and listing processes for mining firms, it might not be easy to win investors’ confidence to purchase shares of a company that has yet to produce its goods. “The bourse has to also take into consideration investors,” he said. Currently, there are 40 mining firms out of total 496 firms listed on the IDX. (Anggi M. Lubis)

Mining firms have to access bourse

JAKARTA. Mining companies look likely to have a chance of raising money from the bourse even if they are still in the exploration stage, as the Indonesia Stock Exchange (IDX) is preparing a new regulation on its facilitation. Once the miners raise funds from the bourse, they will have the capital to boost exploration activities. IDX director for listing, Hoesen, said over the weekend the bourse had early this month submitted a revision of the requirement for mining companies to be listed on the IDX to the Financial Service Authority (OJK). Approval on the revision is expected before the end of the month. The revisions, Hoesen said, would allow miners in the exploration stage, to apply for an initial public offering (IPO) and to have their shares traded on the bourse even before they started producing and further, profiting. Once the revision comes into effect, according to Hoesen, mining companies that had not started production can go for an IPO with mineral deposit data (normally in the form of Joint Ore Reserves Committee Report), feasibility study documents and a business plan. “The deposit data will be audited by a competent independent surveyor to avoid fraud. Companies have to submit a financial report from the preceding year,” Hoesen said, adding miners that had started production but were still recording a loss could also apply for an IPO as long as they booked operating profit. “While waiting for the OJK’s approval, the bourse is currently formulating a guideline for companies’ five-year business plans, which will be offer interested investors assurance on the related firms’ businesses.” The current regulation stipulates that only companies that have operated and have audited financial reports for at least three years can have their shares listed on the bourse’s main index. As exploration takes quite a long time and takes three to five years before producing and profitability, the existing regulation is not “business friendly” to the miners. “It is always hard to raise capital to start mining, especially for first-timers, which usually depend on the owner’s own funds to finance exploitation. Bigger firms have more access to bank loans, usually using other businesses outside mining industry as the mortgage,” Tony Wenas of the Indonesian Mining Association (IMA) said. “Ores are a non-renewable resource. With a lack of capital, many explored areas are left idle due to lack of funds, therefore, a revision that facilitates IPOs will be very much appreciated,” he continued. Tony also emphasized that the bourse and the OJK should involve mining experts and the government to ensure unreliable miners were not listed on the bourse. Corporate secretary of state-run Aneka Tambang (Antam), Tri Hartono, echoed Tony, saying the revision would ease the process for miners, especially as they are now barred from exporting raw ore and obliged to build smelters. The ban, which was brought in earlier this year, stipulates that only finished products can be exported in an attempt to develop the downstream extractive industry and to increase added value for the country. Antam is reportedly preparing three of its subsidiaries — nickel miner GAG Nikel, bauxite miner Mega Citra Utama and gold miner Cibaliung Sumberdaya. “We have a list of subsidiaries that we deem ready to offer their shares to the public, but we will not conduct any IPOs until the revision is ready,” Tri said. Indosurya Analyst William Surya Wijaya said that while the revised stipulation was good to accelerate IPO and listing processes for mining firms, it might not be easy to win investors’ confidence to purchase shares of a company that has yet to produce its goods. “The bourse has to also take into consideration investors,” he said. Currently, there are 40 mining firms out of total 496 firms listed on the IDX. (Anggi M. Lubis)